Using the latest technology and incorporating the best practices gathered from Oracle's customers, Oracle Fusion Applications is a suite of 100% open standards-based business applications that provide a new standard for the way businesses innovate, work, and adopt technology. Delivered as a complete suite of modular, service-enabled enterprise applications, Oracle Fusion Applications works with Oracle's Applications Unlimited portfolio to evolve business to a new level of performance. Whether it is one module, a product family, or the entire suite, Oracle provides businesses with their choice of all advancements pioneered by Oracle Fusion Applications, at a pace that matches individual business demands.

- Standard Based Architecture

- Best Practices Business Processes

- Choice of Deployment options

Oracle Fusion Applications have been designed to ensure your enterprise can

be modeled to meet legal and management objectives. The decisions about your

implementation of Oracle Fusion Applications are affected by your:

• Industry

• Business unit requirements for autonomy

• Business and accounting policies

• Business functions performed by business units and optionally,

centralized in shared service centers

• Locations of facilities

Oracle EBS vs Oracle Fusion Apps:

BPEL (also known as BPEL4WS or WS-BPEL), the Business Process Execution Language is an

XML based programming tool for language service composition.

Fusion Applications uses BPEL wherever process logic is implemented. BPEL replaces Oracle

Workflow. So where in EBS Releases 11i & 12 a process is organized by Oracle Workflow, in Fusion Applications BPEL is used. For example the GL journal approval is handled by Oracle Workflow in Release 12. In Fusion Applications this is done via a BPEL process.

Oracle Fusion Apps:

Oracle Fusion Financials Applications:

1.

Oracle Fusion

Financials, which include general ledger, receivables, payables, asset

tracking, expense management, and cash management functionality.

2.

Oracle Fusion

Accounting Hub, providing the integration and reporting platform to effectively

drive a coexistence strategy with your existing financial systems.

Oracle Fusion

Financials provide features for:

1.

Receivable and

collection functionality within the Order Fulfillment process

2.

Asset accounting and

reporting within the Asset Life cycle Management process

3.

Cash management

functionality within both the Order Fulfillment and Procurement processes

4.

Payable and payment

functionality within the Procurement process

5.

Financial Control and

Reporting including taxation, subledger accounting, general ledger,

consolidation, and reporting functionally

6.

Expenses management

functionality within the Compensation Management process

7.

Multi-GAAP compliance

including approaches for simultaneous compliance with corporate and national

regulators and standards.

8.

Currency compliance

including capabilities for accounting in denomination and accounting currencies

and for translation to functional or reporting currencies as required in

compliance with the relevant principles within both the International Financial

Reporting Standards (IFRS) and United States Generally Accepted Accounting

Principles (GAAP).

.

Oracle Fusion Financials Phases:

Oracle Fusion Financials Phases:

To set

up your companies, ledgers, and business units (BUs), Oracle Fusion

Applications provide the Functional Setup Manager. The Functional Setup Manager

empowers enterprises to decentralize the change management process and enables

business users to change Oracle Fusion applications to fit their evolving

business needs.

Functional Setup Manager:

Functional Setup Manager:

- Provides a predefined, guided list of tasks for a full end-to-end visibility to all setup requirements enabling business users with self-service to implement quickly what they need and when they need it.

- Provides configurability of the Oracle Fusion offerings to mold the offerings to fit the business needs.

- Provides export and import capability to let companies setup one instance and reuse it several times.

- Provides a guided process making it easy to navigate through planning, implementation, deployment, and ongoing maintenance.

- Provides a set of comprehensive reports to give full visibility to setup at any time.

- Getting Started

- Setting Up the Task List

Manager

- Setting Up Import and Export

- Maintaining the Functional

Manager

1.

Plan and Configure phase: (Getting Started)

- Plans and discovers what

offerings, options, and features are available in Oracle Fusion

applications

- Researches the requirements

- Analyzes the impact of the

change

- Selects the most suitable

offering, options, and features based on the requirements

- Creates the implementation

project and assigns tasks

2. Implementation phase

a) Setting up the Task List Manager

- Reviews and executes assigned

setup tasks

- Updates the status of the tasks

- Adds attachments and notes

- Validates the implementation.

b) Setting up Import and Export

·

Creates configuration

packages and exports setup data

·

Imports the

configuration package in another instance

·

Analyzes setup data

report

3. Maintaining the

Functional Manager

- Maintains the environment with

ongoing setup changes

- Updates setups due to event or time-based changes

Financial

Sub-ledger Architectures: Sub ledger architecture includes

- Dashboard and work areas

- Invoice imaging

- Tax

- Sub-ledger accounting

- Reconciling subledger accounts

All Oracle Fusion

Financials applications deploy dashboards. On a dashboard, work areas display

tabulations of the tasks that a given role needs to accomplish. These are

updated by incoming work load in real time. In Payables, for example, newly

scanned invoices are tabulated for the Payables Specialist to process. In

General Ledger, the accounts monitored by the accountant are updated at each

journal posting. In Receivables, new invoices and receipts pending further

actions are listed for the Billing Specialist and Receivables Specialist to

process. The tabulations are designed

to be easily adjusted to suit your needs in several ways and can be modified,

prioritized, and even replaced.

The work areas monitor

processes and provide updates on status. Items awaiting approval, for example,

are listed, as are items with issues, such as incomplete invoices and unposted

journals. Social tools are available, so that any person who needs to act, such

as an approver, can be contacted immediately. The tabulations support searching

by example, saved searches, export to spreadsheet, and other actions, so that

the work can be moved along without using menus or navigating away from the

work area.

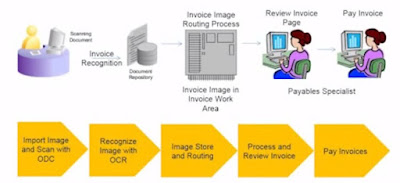

Invoice imaging:

In Oracle Fusion, image

scanning is not just a plug in or add-on. The accounts payable process has been

re-architectured to simplify data capture and eliminate work costs and

activities.

You can scan the

invoice from any location, The scanned

invoice is routed to the shared service center in any part of the world for

centralized processing. The image is read by the system through smart optical

character recognition centrally and the invoice data pages are largely

prepopulated from the images. Imaging and routing facilitates speedy

processing, as the invoice is complete and appears immediately in the work area

of the Accounts Payables (AP) specialists. The AP specialists can compare the

image and the data before approving it. Oracle Fusion Applications manages the

file network system, document repository, image processing server, and the

routing process with little or no human involvement.

Oracle Fusion Tax Architecture:

There

are many kinds of transaction taxes, including sales tax, value-added tax

(VAT), goods and services tax (GST), and customs duties.

The tax architecture includes the following tiers:

- Tax Configuration: Foundation

- Tax Determining Factors

- Tax Configuration: Advanced

- Services

- Tax Management

- Tax regimes and taxes, such as GST, VAT, and sales tax

- Tax jurisdiction and tax authorities, such as California and Ireland

- Tax status of different types of transactions, such as taxable or nontaxable transactions

- Tax rates including recovery rates

The Tax Determining

Factors tier identifies the factors that participate in determining the tax

on an individual transaction. These taxability factors are:

- Parties to the transaction,

such as your companies, vendors, and customers

- Products such as food, books,

automobiles, and furniture, with each product having a different tax

arrangement

- Places of shipment and delivery

- Business processes involved,

such as sales, purchases, and inventory management

For example, you could be a legal entity registered for tax

in Illinois and selling a product to another legal entity that is registered in

Toronto. To sell your product, you must take into account, the following taxes:

- Illinois sales taxes

- US export taxes

- Canadian import taxes

- Toronto taxes

The Tax Configuration:

Advanced

tier leads you away from mainstream compliance into specialist cases. For

example, the advanced configuration includes setting up tax rules to determine:

- Tax regimes

- State sales tax versus a

national customs tax

- Shipment and delivery details

- Registrations, both yours and

your customers and vendors

- Tax basis that results from the

combinations of the above considerations

- Tax rates and recovery rates

Tax

or recovery is calculated based on these and other factors. Tax recovery uses

the Services tier to return the appropriate tax or recovery for the product to

the entity requesting it. Other services include setup and partner integration

services. Third-party tax partners deliver external data, such as tax rates,

simplifying your tax processing.

The Tax Management tier includes:

- Transaction taxes and related

data that are stored in tax repositories and are delivered with reports.

Standard reports are provided that you can use or copy to customize to

meet your tax reporting requirements.

- Configuration data that is

stored in a configuration repository. Tax records are stored in a tax

record repository.

Sub-ledger

Accounting Architecture:

Oracle Fusion Sub ledger Accounting takes data from both external and oracle fusion applications and accounts for that data in oracle fusion general ledger, populating the balances cube and preparing data for the sophisticated reporting capabilities available in the General ledger.

Sub ledger accounting uses a set of rules that it applies to sub ledger transaction data to determine the accounts to which the data is posted and to format & present the entries appropriately, using the rules the subledger accounting engine generates sub ledger journals and stores them in the sub ledger accounting repository as the preceding figure illustrates. It creates sub-ledger balances by customer and vendors. Sub-ledger accounting populates the sub-ledger balances and creates general ledger journals based on the frequency details and formatting options that you specify. The general ledger journals are recorded in the general ledger balance table and cube.

Sub-ledger Accounting is capable of generating entries for the same data according to different rules, facilitating reporting compliance to different conventions, such as statutory and corporate, or such as the old and the new principles when a new accounting principle is promulgated. It is anticipated that the Convergence of International Financial Reporting Standards (IFRS) and US Generally Accepted Accounting Principles (GAAP) will involve retrospective reporting under Leases, Revenue Recognition, and Financial Instruments for all US GAAP and IFRS filing groups.

Financial Control and Reporting:

The Financial Control and Reporting process delivers greater control of your enterprise financial management activities. It provides key users with better visibility of the entire process -- from capturing transactions and closing sub-ledgers to financial consolidation and reporting processes. The process provides greater accuracy in updating and reconciling general ledger accounts, with checks and balances across all subledger systems.

Reference: https://docs.oracle.com/en/ and https://support.oracle.com, Fusion user guide and implementation guides.